Once the tax rate for your Store products is created, the tax is applied to products automatically.

See how the Tax gets applied to a Product:

As the Shipping Address contains British Columbia, Canada, the country tax of Canada (12%) plus the state tax of British Columbia (3%) i.e., 15% gets added to the product price when the Add to Product Prices is selected.

When the Include in Product Prices is selected this tax gets included in the product price itself.

When the Use instead of the Country Tax Rate option is selected, the state tax rate (i.e., 3%) only gets applied (not the Country tax).

Tax exemption on a specific product

To eliminate the tax on a specific product, follow these steps:

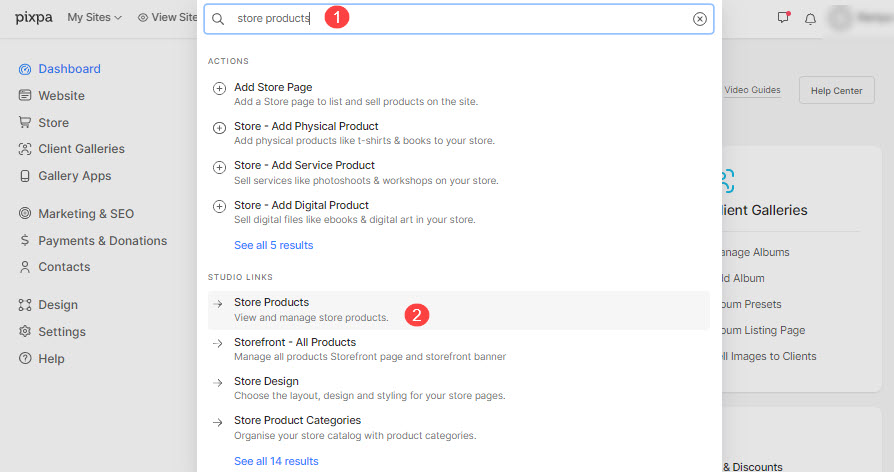

- Enter store product (1) in the Search Bar.

- From the related results, click on the Store Products option (2) under Studio Links.

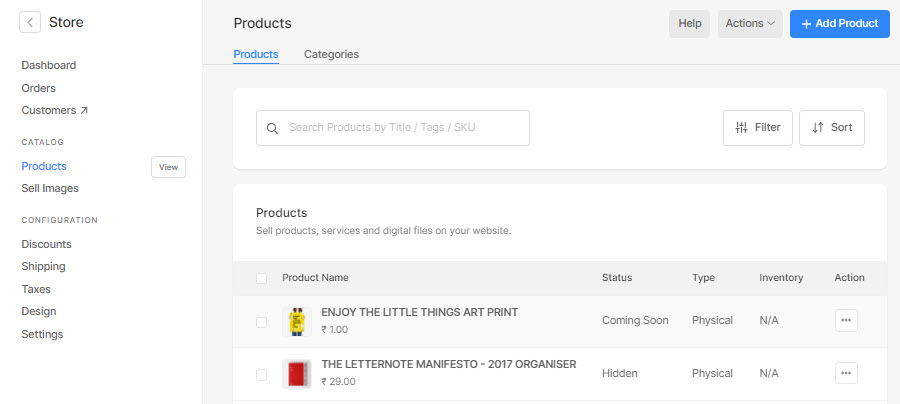

- On this page, you would see the list of all the products. Click on any particular product to visit the product edit page.

- You would find the This product is Tax-exempt (1) option here.

- Check this option and click on the Save (2) button to save your changes.

- As the tax exemption is turned-on on this product, the tax will not be applied to it and the Checkout page will be as shown below (with 0 tax rate):